Capitol Roundup is NC Farms Bureau’s weekly video and email report that summarizes key legislative developments and explains in clear terms how those developments affect agriculture.

NCGA approves new maps, moves toward adjournment (October 28, 2023)

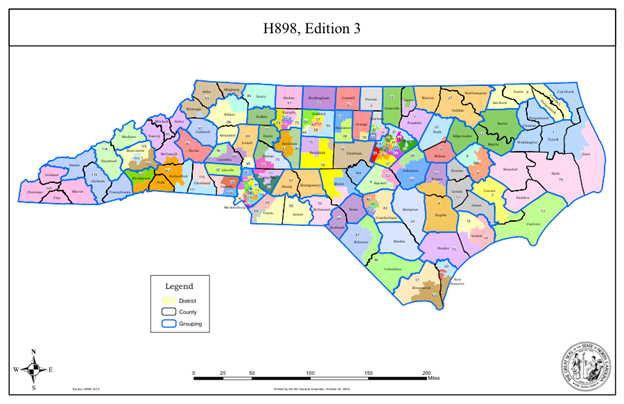

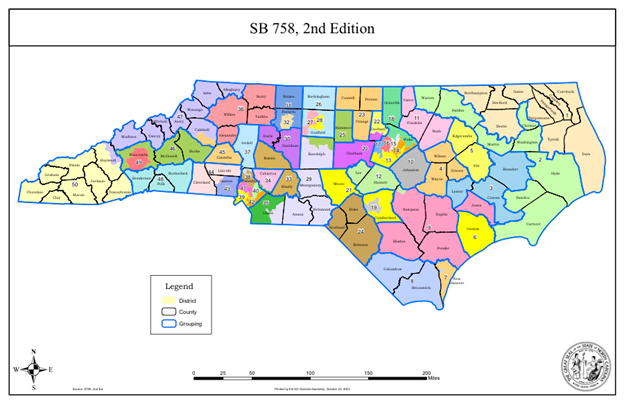

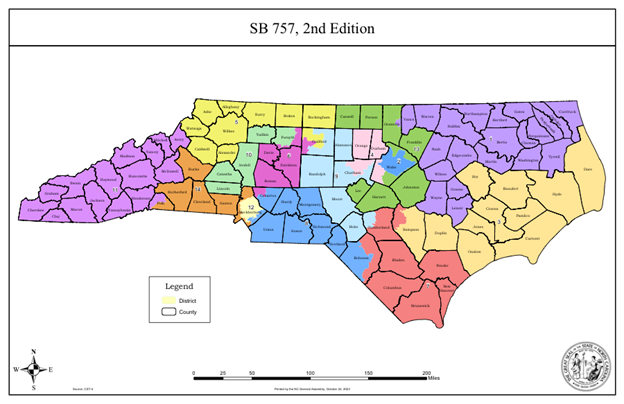

State lawmakers redrew the maps for the N.C. House, N.C. Senate and U.S. Congress districts this week and passed the new maps along party lines. The Governor has no authority to veto the maps, so they are now law and take effect for the 2024 elections.

With their last major order of business complete, the N.C. General Assembly has adjourned until November 29.

Please see the maps below:

N.C. House – https://webservices.ncleg.gov/ViewBillDocument/2023/7589/0/Edition%203%20-%2011%20x%2017%20Map

N.C. Senate – https://webservices.ncleg.gov/ViewBillDocument/2023/7523/0/Edition%202%20-%2011%20x%2017%20Map

U.S. Congress – https://webservices.ncleg.gov/ViewBillDocument/2023/7521/0/Edition%202%20-%2011%20x%2017%20Map

For more information about these bills or any others of interest, visit the North Carolina General Assembly website, www.ncleg.gov. Bills are searchable by bill number and subject.